Added principal mortgage calculator

As you make mortgage payments your principal balance will decrease. Your mortgage principal balance is the amount that you still owe and will need to pay back.

Mortgage Calculator Estimate Your Monthly Payments

You can use the Zillow Home Loans to find out your monthly mortgage amount that includes principal and interest property taxes and homeowners insurance.

. Youve paid 85000 and have a balance of 115000 left on your mortgage. Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. With the extra principal you paid.

As the principal is amortized the stored funds can be used as a source to take out cash when needed and borrowed without charge. Our mortgage payment calculator is a fantastic resource for anyone looking to purchase a home. Use this free online calculator to see how much you will need to pay each month to pay your loan off in a set amount of time.

Lets say you are 3 years into a 30-year 500000 home loan with a 100 offset account which you havent yet added any savings toYou have built up some money. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies. See how changes affect your monthly payment.

Step by Step Instructions for Using the Zillow Home Loans. The good news is as you continue to make mortgage payments and the principal is reduced a higher portion of your payments will go toward paying down the mortgage principal. The most common mortgage term in Canada is five years while the most common amortization period.

View matching homes in your price range and see what you can afford. Estimating your monthly payment with our mortgage calculator or looking to prequalify for a mortgage. Ask About Prepayment Penalty.

Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates. You can calculate a monthly mortgage payment by hand but its easier to use an online calculator. This free mortgage calculator lets you estimate your monthly house payment including principal and interest taxes insurance and PMI.

Added payments count whether its a large sum or small incremental amounts at recurring intervals. The premium is divided by. Offset savings example calculation.

This is the total amount youre financing including the purchase price of the home minus any down payment and sometimes closing costs or other fees. Use this free Florida Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more.

On a reverse mortgage interest charges are added to your outstanding loan balance which then rises each month creating whats called. Whether you added a little to your monthly mortgage payment or paid a large one-time lump sum. Our calculator includes amoritization tables bi-weekly savings.

Each month you pay off some of the principal and you pay off the interest that accrued that month. Youll need to know your principal mortgage amount annual or monthly interest rate and loan term. If you wish to figure out what you can afford for a home you need to tally your monthly mortgage payment.

A mortgage allows the option of building up a cash account. While youll find PITI on virtually all mortgage payment breakdowns you may also have other expenses like. There is a difference between amortization and mortgage termThe term is the length of time that your mortgage agreement and current mortgage interest rate is valid for.

How to pay off your mortgage faster. Well help you compute PMI principal interest taxes insurance. See how your monthly payment changes by making updates to.

Thats because any interest owing is paid first. Our mortgage calculator includes principal and interest based on your input and estimates property taxes and insurance which you can update for a more accurate monthly mortgage payment estimate. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

If you buy a home for 400000 with 20 down then your principal loan balance is 320000 I Interest. The first one makes extra payments at the start of the term while the second one starts making extra payments by the sixth year. If you are a Scotiabank mortgage customer depending on the mortgage solution that you select each year you can increase your scheduled monthly payments by up to 10 15 or 20 of the payment initially set for your term or in some cases your current payment and make a lump sum prepayment of up to 10 15 or 20 of your original principal amount without incurring a.

We used the calculator on top the determine the results. Or if you are already making monthly house payments this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments per year. You can stop your loan from rising by repaying either interest only or principal plus interest.

The amount you owe without any interest added. The mortgage amortization period is how long it will take you to pay off your mortgage. Check out the webs best free mortgage calculator to save money on your home loan today.

This is how much itll cost you over time to borrow this amount of moneyIn other words this is how much the lender will charge as payment for giving you the mortgage. After use the amounts are simply added back to the mortgage principal. There are also options for flexible or skipped payments.

Early Mortgage Payoff Calculator. Homeowners insurance can be paid annually by your lender. To show you how this works lets compare two 30-year fixed mortgages with the same variables.

30-Year Fixed Mortgage Principal Loan Amount. The amount of interest you. This calculator will calculate the weekly payment and associated interest costs for a new mortgage.

Paying off your mortgage may seem like a distant dream at first. The amount of interest that you pay will depend on your principal balance. Mortgage Details 50 per month 100.

This means that when you get a mortgage and borrow 400000 your mortgage principal will be 400000.

Early Mortgage Payoff Calculator Mls Mortgage Amortization Schedule Mortgage Refinance Calculator Mortgage Payoff

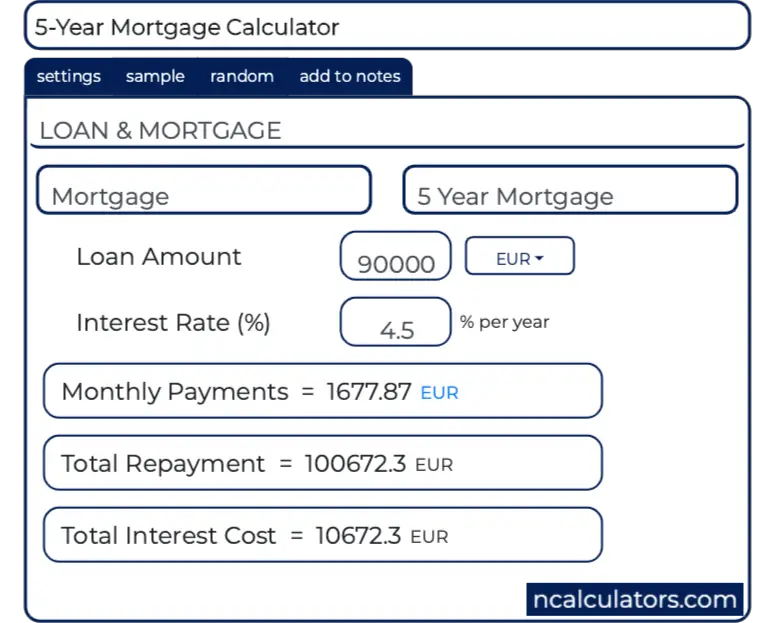

5 Year Mortgage Calculator

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Extra Payment Mortgage Calculator For Excel

Downloadable Free Mortgage Calculator Tool

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage With Extra Payments Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Simple Mortgage Calculator

Arm Calculator Free Adjustable Rate Mortgage Calculator For Excel

Mortgage Repayment Calculator

Free Interest Only Loan Calculator For Excel

Online Mortgage Calculator Wolfram Alpha

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Excel Mortgage Calculator How To Calculate Loan Payments In Excel